Mastering the 8 steps of the accounting cycle is essential for business success. This structured process allows companies to accurately capture and document every financial transaction, providing a reliable basis for financial reporting. Businesses that handle these steps well can avoid common financial pitfalls, ensuring operational and financial success.

Importance of the Accounting Cycle

The accounting cycle is a structured method to track every financial movement in a business. These steps guarantee that your records are precise, minimizing the risks of error and ensuring your business complies with regulatory demands. A well-executed accounting cycle means your financial decisions are always based on solid information.

What Is the Accounting Cycle?

The accounting cycle serves as a blueprint for managing all the financial transactions within a business. Everything flows through this method from sales to expenses, ensuring consistency and precision in the records. Without the accounting cycle, it would be difficult for businesses to maintain accurate financial records, which are crucial for decision-making and compliance.

Why Businesses Need It

The accounting cycle helps companies track all transactions in an organized way. Without it, businesses risk missing critical information, leading to errors and misinformed decisions. It also simplifies generating financial statements, making evaluating the company’s performance easier.

How 1800Bookkeeping Can Help

At 1800Bookkeeping, we offer tailored solutions to simplify your financial processes and ensure the accuracy of your records. Here’s how we can assist you at every stage of the accounting cycle:

- Automated Transaction Recording: We ensure that all financial transactions are accurately identified and recorded, minimizing manual errors.

- Journal Entry Management: Our experts categorize and post your journal entries to the appropriate accounts, maintaining clear and accurate financial records.

- Trial Balance & Adjustments: We calculate your trial balance and handle adjusting entries to keep your accounts current.

- Comprehensive Financial Reporting: From income statements to cash flow analysis, we generate financial statements that provide valuable insights into your business performance.

- Closing the Books: We help close your books at the end of each accounting period, ensuring a smooth transition and clear separation of financial periods.

Let us handle the complexities of the accounting cycle so you can focus on growing your business. Contact us today to streamline your bookkeeping and keep your finances in perfect order.

How Does the Accounting Cycle Work?

This cycle repeats during each accounting period, whether monthly, quarterly, or annually. It begins with identifying transactions and closing the books for that period. This approach allows businesses to continually update their financials, ensuring the data is always complete and reliable.

The Steps Repeated Over Time

The same steps are repeated each accounting period, giving businesses a consistent method for updating their financials. This repetition helps businesses stay organized and prepared for financial evaluations at any time.

Why Is the Accounting Cycle Important?

The accounting cycle is a crucial process that underpins the financial health of any business, regardless of size. By following this structured approach, businesses can:

- Maintain financial integrity: Ensure that their financial records are accurate, reliable, and consistent.

- Comply with tax laws: Avoid costly errors and penalties by accurately tracking income, expenses, and deductions.

- Improve decision-making: Gain valuable insights into the business’s financial performance, enabling informed choices that drive growth.

- Enhance transparency: Provide stakeholders with a clear and accurate picture of the business’s financial health.

Ensuring Compliance and Accuracy

Accurate financial records are essential for regulatory compliance and maintaining credibility with stakeholders. Errors in the accounting process can lead to:

- Fines and penalties: Non-compliance with tax laws can result in significant financial penalties.

- Legal issues: Inaccurate financial records may be used as evidence in legal disputes.

- Loss of trust: Stakeholders, including investors, lenders, and customers, may lose confidence in the business if it has unreliable financial information.

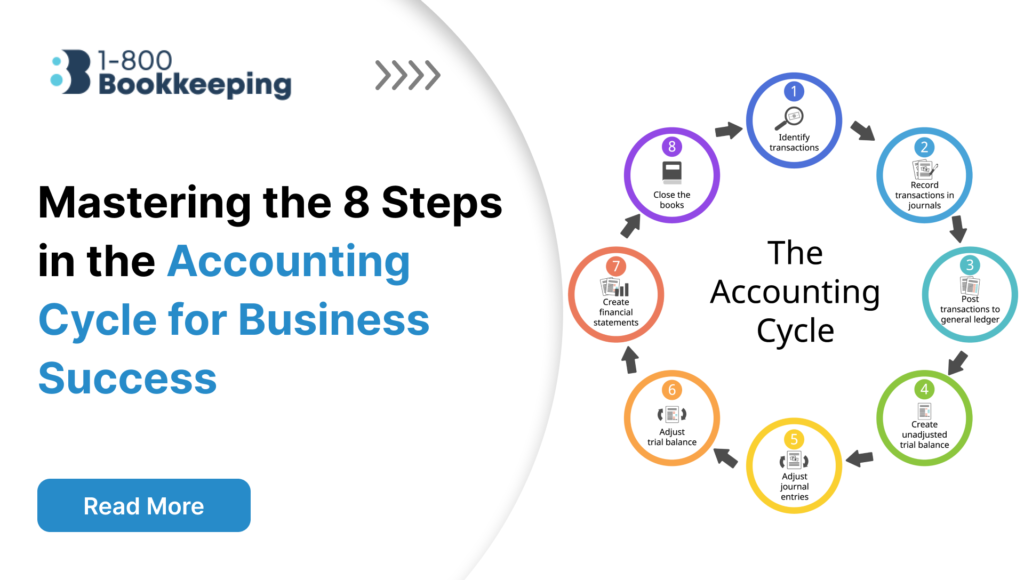

Breaking Down the 8 Steps in The Accounting Cycle

The 8 steps in the accounting cycle provide a systematic way to manage your financials. Each stage, from identifying transactions to closing the books, ensures accurate financial data. Let’s dive into each step to understand its role in financial reporting.

Step 1 – Identify Transactions

The first step in the accounting cycle is identifying all the financial transactions in a given period. These can include sales, purchases, expenses, and payments. Each transaction must be noted carefully to ensure the next steps in the cycle work smoothly.

Examples of Financial Transactions

Sales receipts, invoices, and bank statements are common financial transactions that businesses must document. These records help provide a comprehensive view of your business’s economic health.

Why Identification Matters

The entire accounting cycle can be thrown off track if transactions are not properly identified. Correctly noting each transaction hinges on the accuracy of all subsequent steps.

Step 2 – Prepare Journal Entries

After identifying transactions, the next step is creating journal entries. This involves recording each transaction in a journal according to its type. For example, sales transactions go into the sales journal, and purchase transactions go into the purchases journal.

Recording Best Practices

It’s crucial to ensure the accuracy of these entries. Double-checking the details before recording can prevent errors. The goal is to describe each transaction and provide balanced debits and credits.

Avoiding Common Errors

Misclassifying transactions, forgetting to record dates, or failing to balance debits and credits are frequent mistakes. Avoid these to maintain accurate records and ensure smooth financial reporting.

Step 3 – Post Journal Entries to the General Ledger

Journal entries are then posted to the general ledger. This record serves as the foundation for financial reporting. Every transaction must be posted accurately to reflect the business’s economic status.

The Role of the General Ledger

The general ledger is the complete record of all financial activities within a business. Preparing accurate financial statements, such as balance sheets and income statements, is essential.

Importance of Accuracy

Errors in the general ledger can cause significant issues. A minor mistake could result in inaccurate financial statements and misleading business decisions.

Step 4 – Calculate the Unadjusted Trial Balance

At this stage, all accounts are reviewed to ensure debits and credits balance. This provides a quick check of the accounting work before any necessary adjustments are made.

Spotting Errors Early

The trial balance helps you identify discrepancies early, allowing you to correct mistakes before they affect your financial reports.

Step 5 – Post Adjusting Journal Entries to General Ledger

Adjusting entries account for any accrued expenses or depreciation that must be recorded at the end of the accounting period. These adjustments are essential for accurate reporting.

Common Adjustments

These include depreciation of assets or recording expenses that have been incurred but not yet paid.

Step 6 – Calculate the Adjusted Trial Balance

With adjustments in place, the trial balance is recalculated to ensure all accounts reflect the correct balances. This ensures accuracy before moving on to financial statement preparation.

Step 7 – Prepare Financial Statements

Based on the adjusted trial balance, prepare the key financial statements, including the income statement, balance sheet, and cash flow statement. These reports offer critical insights into your business’s financial standing.

Financial Statements You Need

- Income Statement: Summarizes your business’s revenues and expenses during a specific period.

- Balance Sheet: A snapshot of your company’s assets, liabilities, and equity.

- Cash Flow Statement: Tracks cash inflows and outflows.

Driving Business Decisions

These financial statements offer valuable insights that inform key decisions. By analyzing these reports, you can identify areas of strength and opportunities for improvement in your business.

Step 8 – Post Closing Journal Entries to Close the Books

In this final step, temporary accounts like revenues and expenses are closed. This resets the accounts for the new period and prepares the business for the next accounting cycle.

Closing Temporary Accounts

Revenue and expense accounts are zeroed out, and their balances are transferred to permanent accounts. This helps ensure financial records are clean and ready for the next period.

Keeping Records Organized

Closing the books properly maintains an organized record-keeping system, making it easier to track business performance over time.

Conclusion

Mastering the 8 steps in the accounting cycle is key to accurate financial records and better business decisions. By understanding and implementing these steps effectively, you can maintain financial clarity and avoid common pitfalls. If you want expert assistance with your accounting cycle, 1800Bookkeeping offers tailored services to simplify your financial management. Let us help you streamline your bookkeeping process and keep your business on track. Contact us today for more information on how we can assist your business.

Don’t let Bookkeeping Overwhelm You. Hire 1-800 Bookkeeping

Running a business is demanding, and keeping track of your finances can be a never-ending chore. Many business owners need help with the complexities of bookkeeping, which can leave them frustrated and behind.

1-800 Bookkeeping offers expert services to streamline your financial processes and empower you to make informed decisions.

Our team of seasoned professionals understands the unique challenges businesses of all sizes face. We can help you:

- Free Up Valuable Time: Offload your bookkeeping tasks to our dedicated professionals.

- Gain Peace of Mind: Ensure your financial records are accurate and up-to-date.

- Make Smarter Decisions: Get actionable insights into your business performance through clear and concise reports.

- Feel Confident: Make informed financial decisions based on reliable data.

Don’t let bookkeeping hold you back from achieving your business goals. Contact 1-800 Bookkeeping today for affordable bookkeeping solutions.

FAQs:

1. What is the accounting cycle?

The accounting cycle is a systematic process for recording and managing financial transactions within a business, ensuring consistency and accuracy in financial reporting.

2. Why is the accounting cycle important for my business?

The accounting cycle ensures that financial records are accurate and comply with regulatory requirements, enabling informed business decisions and helping avoid legal issues.

3. What are common mistakes made during journal entries?

Common mistakes include incorrect transaction classification, missing dates, and failing to balance debits and credits, which can lead to inaccurate financial statements.

4. How does the general ledger impact financial statements?

The general ledger is the master record for all financial transactions. Errors in the ledger can lead to incorrect financial statements, which can affect business decisions.

5. What are adjusting journal entries?

Adjusting entries account for non-cash transactions like accrued expenses and depreciation, ensuring that financial records accurately reflect the business’s activities.